This and that. After the flumox comes the fluff. And, then the facts.

kill the messenger because you don’t understand the message .

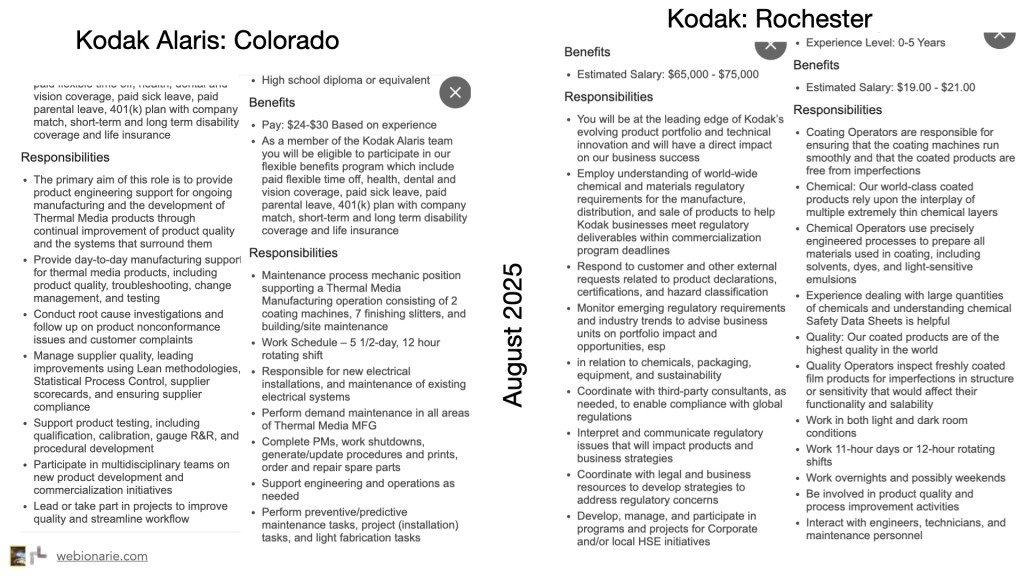

Something about what they do: who do they hire. How much do they pay. What do those people do.

The digested version: Kodak Alaris pays more than Eastman Kodak. Their jobs require automation control knowledge. Kodak Alaris,aka Moments, is all about Thermal Media. That is the estimated growth area. Your photographic Moment on a mug, shirt, mouse pad? Somewhat like what Fujifilm did with their US plant they had planned to close. Remember that? Oh what a greenfield time, just 20 years ago.

Kodak rochester — that’s the emulsion place. Check out “leading edge” engineer evolving product portfolio, etc. $75,000. Of course Rochester is cheap to live. Snow mobiles and snow plows are your friend. The coating technician works in the dark for $21/hr. Reminder, being a Kodak technician is more prestigious than a Burger King shift opener.

— Kodak Alaris Colorado is the home of Kodak Moments Thermal Media Manufacturing and the Windsor Regional Distribution Center. The operations are responsible for the manufacturing and distribution of thermal media for photographic applications.”

None of this is part of the discussion concerning the break-up, make-up, move faster with less taking place weekly at a fast-food forum near you. First glance was supported by weak background knowledge. The press reports were accurate, but alarming.

backstory: Kodak tacked on a “Going Concern Assessment” in its Q2 financial report. That set off the headlines. Those assessments are usually buried in 10-Q and 10-K statements. Then, along comes the’blu-collor’ fisherman, Kodak. “We manufacture a wide range of products in the U.S., including lithographic printing plates, photographic and industrial films, inkjet presses and inks, and pharmaceutical key starting ingredients—and our expectation is that tariffs instituted by the U.S. government are designed to protect American businesses like ours,” said Kodak CEO Jim Continenza.

Support to his stock and Presi. The follow-up comment was a support to stock price, that is, to the compensation scheme of the c-suite. Consider the people behind the scurry, hurry.

Kodak executive personnel

- James “Jim” V. Continenza

- • Current position at Kodak: Executive Chairman and Chief Executive Officer.

- • Previous position at Vivial: Chairman and Chief Executive Officer.

- Jim Barnes

- • Current position at Kodak: Chief IT Implementation Officer, reporting directly to Jim Continenza.

- • Previous position at Vivial: Chief Information and Technology Officer.

- Jim Moran: Currently Kodak’s Chief Administration Officer and President of Eastman Business Park, he previously served as Vivial’s COO.

- Denisse Goldbarg: Now Kodak’s Chief Marketing Officer (CMO), she previously held the same title at Vivial.

- Laura Cole: Currently Kodak’s Vice President of Pricing and Product Management, she was Vivial’s Vice President of Marketing.

- Jeanne hilley served as the Vice President, Human Resources for Vivial Inc

Vivial acquisition :In January 2022, Vivial was acquired by Thryv Holdings Inc.,. Vivial was marketing tech and communications firm. Kodak’s current C-suite built a company worth $22million. They weren’t brought into the buyer company.

Notes:

10K reports are due annually and must include audited financial statements, 10Q reports are due quarterly, three times a year, and include unaudited financial statements. Companies with more than $10 million in assets and a class of equity securities that is held by more than 2000 owners must file annual and other periodic reports, regardless of whether the securities are publicly or privately traded. Up until March 16, 2009, smaller companies could use Form 10-KSB. If a shareholder requests a company’s Form 10-K, the company must provide a copy. In addition, most large companies must disclose on Form 10-K whether the company makes its periodic and current reports available, free of charge, on its website. Form 10-K, as well as other SEC filings may be searched at the EDGAR database on the SEC’s website. Academic researchers make this report metadata available as structured datasets in the Harvard Dataverse

Pathways Taken; Available.

what Kodak Alaris sells that would be of interest to a capital expansion firm

Kodak Alaris was bought by Kingswood Capital Management. Kingswood has completed two full exits and two partial realizations from its Kingswood Capital Opportunities Fund I (closed in 2021) and started delivering proceeds from its Kingswood Capital Opportunities Fund II (closed in 2022). The firm’s latest reported exit was from Mountain Equipment Company (MEC) on May 16, 2025, and its first full exit was in December 2021, when it sold Senture to Teleperformance.

Key Exits

- • Mountain Equipment Company (MEC): This was the latest exit, completed on May 16, 2025.

- • Senture: The firm’s first full exit, sold to Teleperformance in December 2021.

Other Exit Activity

- • Partial Realizations: In addition to full exits, the firm also achieved two partial realizations from Fund I, a private equity fund closed in 2021.

- • Pre-Fund Deals: Kingswood also made three smaller deals during its “independent sponsor era” before raising commingled funds. Two of these deals were exited, and the firm is still holding the third.

The path taken by Sino-Promise seems to have been similar to current KA/ Kingswood, but with a mix of ‘dry-lab’ output from the “moments” for your scrapbook, t-shirt, mouse-pad.

Reminder .. Fujifilm’s Greenwood plants.

And, the other tree in the copse: https://find-and-update.company-information.service.gov.uk/company/05227615/officers

You must be logged in to post a comment.